Financial education is crucial for helping employees maximize their retirement benefits and reduce financial stress. Below, we include our Best Practices for Participant Education.

The Advisor’s Role in Education

Advisors can leverage education as a competitive advantage to support both participants and employers.

- Position yourself as a strategic partner by offering tailored educational resources.

- Start small, measure outcomes, and continuously improve educational offerings.

- Establish a structure to review findings with your Plan Sponsors.

Start with Listening

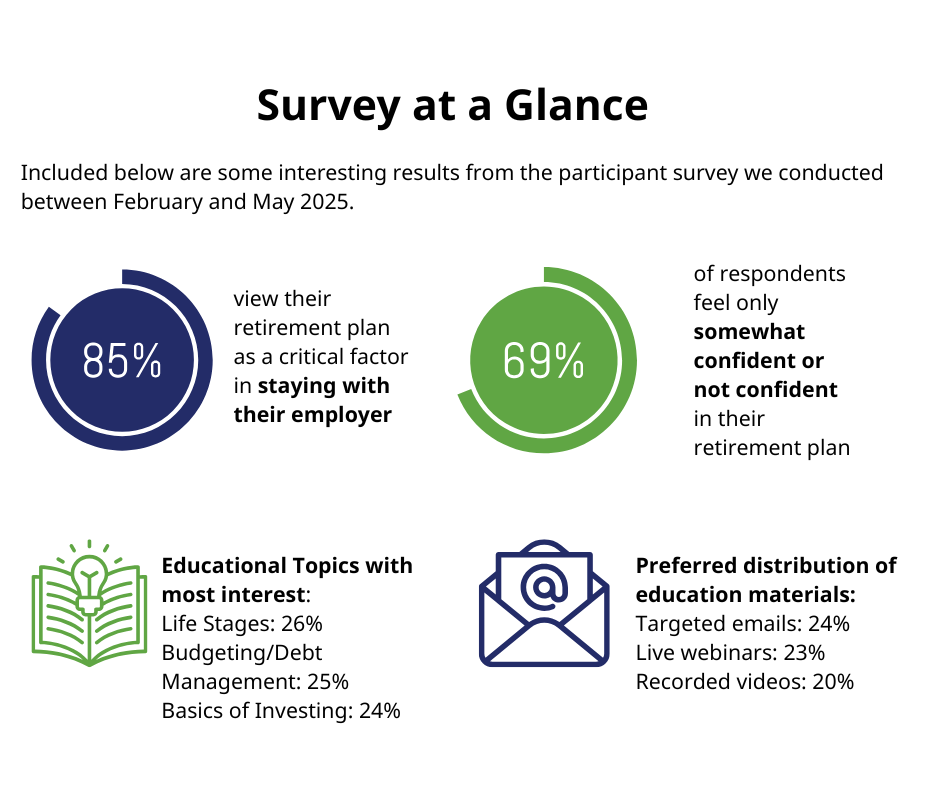

Listening to employees is the key to enhancing engagement and tailoring educational content. We encourage you to survey plans individually for maximum engagement. In the first and second quarter of 2025, we surveyed individuals from across numerous industries and companies, including our own.

Using these survey results, the BPAS Signature Services team was able to identify relevant topics and effective communication methods to tailor custom education campaigns to meet employees where they are, increase participation and engagement, and help guide them to a secure financial future.

Data-Driven Strategies for Engagement

Analyzing participant behavior can lead to improved retirement readiness and engagement. We recommend reviewing your plan metrics, which are readily available in the Plan Portal and through our Quarterly Plan Review Report, such as:

- participation rates

- average deferral rates

- retirement readiness

Using these plan metrics as a benchmark, identify areas for improvement and target audiences, including employees:

- Eligible but not participating

- Not meeting the match

- With no beneficiaries on file

- With loan activity

- Activity in Pre-Tax vs. Roth Contributions

Conducting Effective Participant Education Sessions

Once you’ve completed your surveys and data review, plan to host short, engaging education presentations. Brief presentations can significantly improve participant retention and action.

- Aim for 20-25 minute sessions with interactive elements like polls and quizzes.

- Include time for audience questions.

- Encourage participants to take actionable steps following the session.

Measuring the Impact of Education

Tracking metrics is essential for assessing the effectiveness of educational initiatives. After implementing an educational campaign, measure and review the impact of targeted metrics with the retirement plan committee.

- Monitor changes in employee participation rates, contribution rates, account access, and more.

- Conduct a follow up survey to indicate areas of comprehension and new topics to consider.

- Review open rates of email campaigns to evaluate success.

The results of an effective employee education campaign may improve the employees perception of their employer’s offerings, improved financial well-being, and lower turnover.

The information provided in this blog post is for informational purposes only and should not be considered as financial, legal, or professional advice. Always consult with a qualified professional for specific advice tailored to your individual circumstances.